I. NC Management GmbH

1. Transparency of Sustainability Risk Policies

Due to the investment focus and the nature of potential target companies in the technological/software sector, NC Management GmbH (“NC Management“, LEI: 391200WJQ18NB0INKL81) generally does not expect ESG events or conditions, if they occur, to cause an actual or a potential material negative impact on the value of investments or future returns (so-called “Sustainability Risks” within the meaning of SFDR). Sustainability Risks are therefore not prominently integrated into NC Management’s investment decisions.2. No Consideration of Adverse Impacts of Investment Decisions on Sustainability Factors

NC Management does not consider adverse impacts of its investment decisions on sustainability factors and, hence, does not use the sustainability indicators listed in Annex I of the Regulatory Technical Standards (Commission Delegated Regulation (EU) 2022/1288, “RTS”) to identify and assess potential adverse impacts.Sustainability factors mean environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters. Given that the SFDR, the Regulation (EU) 2020/852 (“EU Taxonomy”) and the accompanying RTS are relatively new legislative acts, there is very little or no practical experience or practice with regard to the application of their respective provisions. Therefore, substantial legal uncertainties would remain when applying those provisions to the strategies pursued by NC Management. If and to the extent that the legal uncertainties will be resolved and a practicable market and administrative practice will evolve in this regard, NC Management will re-evaluate considering principal adverse impacts of its investment decisions in due course.

Further, the funds managed by NC Management may also hold significant minority interests or shares in Portfolio Companies. Hence, NC Management cannot constantly ensure access to the relevant data from Portfolio Companies for the assessment of principal adverse impacts on sustainability factors and cannot currently provide the information in relation to the consideration of adverse impacts of its investment decisions on sustainability factors as provided in the SFDR.

In addition, data collection and data quality are sometimes difficult for small portfolio companies, as data collection is often an economically disproportionate burden for the usually small management teams of portfolio companies.

3. Remuneration Disclosure

As a registered alternative investment fund manager within the meaning of section 2 (4) of the German Investment Code (Kapitalanlagegesetzbuch, “KAGB”), NC Management does not have a remuneration guideline or policy.II. NC Growth Fund I GmbH & Co. KG

1. Summary

NC Growth Fund I GmbH & Co. KG (“NC Growth Fund I”), managed by NC Management, promotes environmental and social characteristics.NC Growth Fund I focuses on equity and equity-related investments in growing tech companies mostly focusing on business-to-business software products that help to ease customers’ and employees’ lives, mainly in the DACH region.

NC Growth Fund I’s framework for integrating ESG matters in the lifetime of an investment incorporates four phases: sourcing and screening, pre-investment due diligence, portfolio, and exit.

Each investment is being assessed against a binding exclusion list relating to specific industries and products and will not pursued if it is in conflict with the exclusion list. The exclusion covers inter alia weapons or ammunition, hardcore pornography, tobacco, gambling and human cloning. 100% of the invested capital will be in line with the exclusion list which will be taken into account during the entire investment process.

Additionally, each investment will be examined for ESG related data before the investment and on a regular basis throughout the lifetime of the investment.

The ESG related data will be collected by NC Growth Fund I on a recurring basis from its portfolio companies. For this purpose, NC Growth Fund I uses a co-developed software platform to ensure thorough documentation of derived measures and overall ESG development per portfolio company. NC Growth Fund I monitors the ESG KPIs corresponding with the environmental and social characteristics and report them annually to its investors.

Throughout the holding period NC Growth Fund I actively engages with the portfolio company’s management to monitor and manage ESG matters. In cases where material ESG risks are identified and deemed inacceptable, a plan is developed and agreed with the management to improve or remedy the issue.

2. No Sustainable Investment Objective

NC Growth Fund I promotes environmental or social characteristics (Article 8 SFDR) but does not have sustainable investments as its objective (Article 9 SFDR).3. Environmental or Social Characteristics

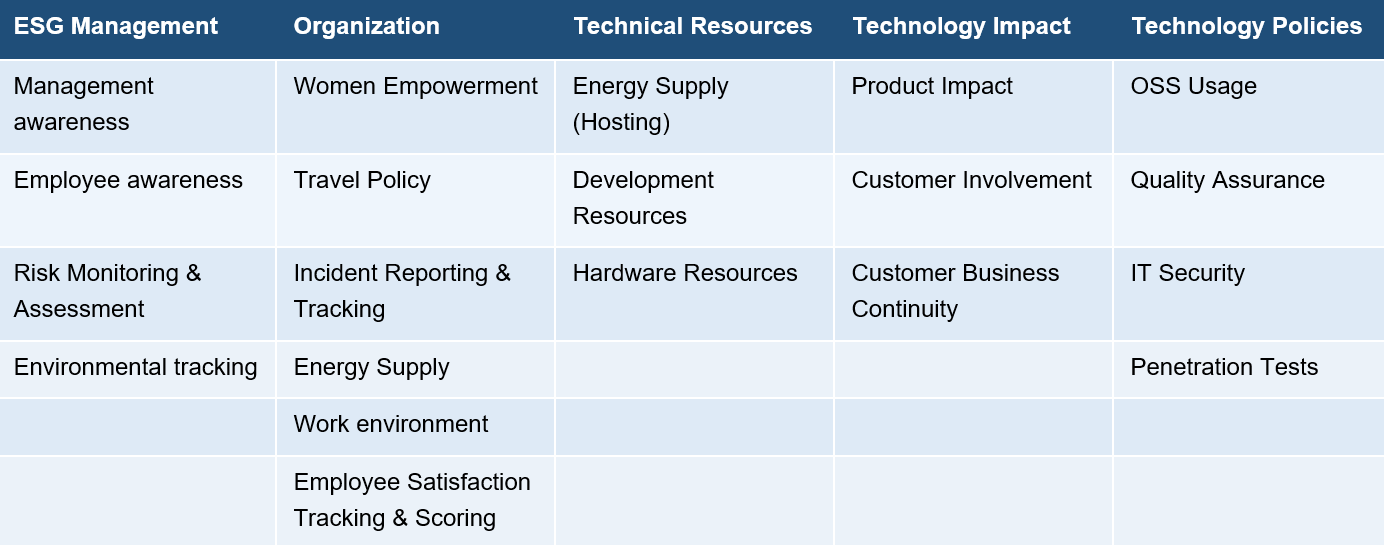

NC Growth Fund I does not commit to make sustainable investments within the meaning of the SFDR or with an environmental objective aligned with the EU Taxonomy. However, NC Growth Fund I targets that all of its investments will be aligned with the environmental and social characteristics promoted by NC Growth Fund I.NC Growth Fund I promotes the following environmental and social characteristics:

4. Investment Strategy

NC Growth Fund I intends to build, hold and manage in its own name and for its own account a portfolio of equity and equity-related investments in growing tech companies mostly focusing on business-to-business software products that help to ease customers’ and employees’ lives. Those target companies typically have many of the following characteristics:- Predominantly founder-owned, i.e. have not been financed by the typical series A, B and other founding rounds;

- Founders have grown their company bootstrapped in a capital efficient way;

- Their (B2B-) software product has been diligently developed over a period of many years driven by customer requests;

- The target company has a scalable software product, only lacking the scale-up experience and the financial means for faster growth;

- The target company achieves sales of about € 3m - € 10m and is or is on the verge of being cash-flow break even, i.e. it is a proven business model since the company attracted enough customers that are willing to pay for the products. Hence this company is not a VC investment;

- The companies have a strong USP and operate in growing markets.

The investment strategy guides investment decisions based on factors such as investment objectives and risk tolerance. NC Growth Fund I intends to promote environmental and social characteristics as described above and has adjusted its investment strategy accordingly.

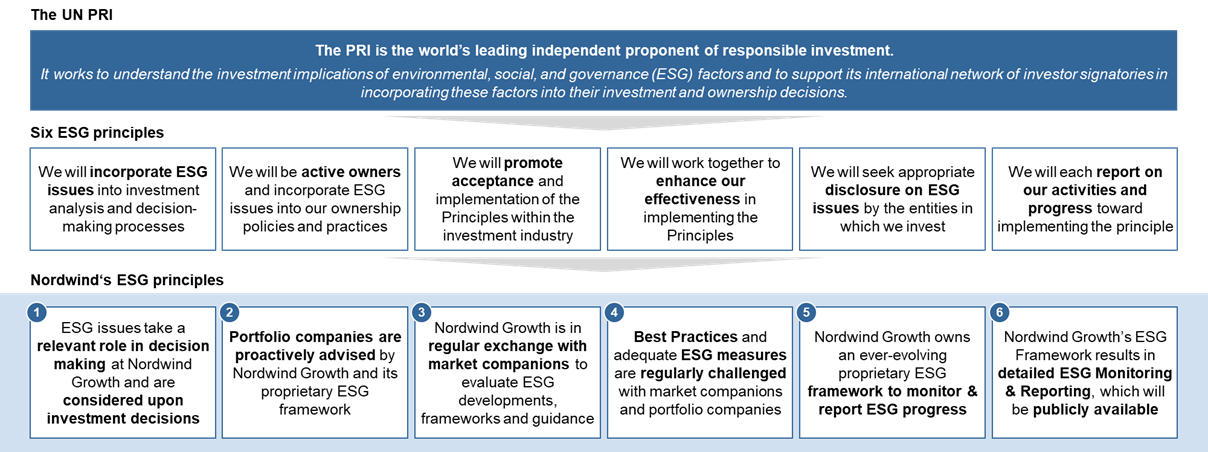

To measure how the environmental and social characteristics are attained, a proprietary framework based on the UN Principles for Responsible Investment (UN PRI) has been developed. Starting from the UN PRI, the Fund derived six company principles:

NC Growth Fund I applies a binding exclusion list that prevents NC Growth Fund I from investing into the following industries in order to attain the environmental and social characteristics of NC Growth Fund I:

- casinos or other gambling facilities;

- hardcore pornography or the sex industry;

- human cloning or genetically modified organisms (GMOs);

- coal mining and/or coal-fired power plants;

- a utilities company that derives 50% or more of its fuel mix from coal, unless such utilities company derives 10% or more of its fuel mix from renewable resources such as hydro, wind or solar;

- tobacco;

- weapons and ammunition; or

- development or production of nuclear weapons.

NC Growth Fund I is committed on best-in-class due diligence processes in various areas. Each potential investment is dissected in terms of commercials, technology, legal, tax as well as ESG characteristics. The ESG due diligence is based on NC Growth Fund I’s proprietary framework to ensure objectivity and measurability.

5. Proportion of Investments

NC Growth Fund I targets to invest 100% of its capital commitments in portfolio companies that meet the environmental and social characteristics promoted, particularly all investments shall be in line with the exclusion list as mentioned above in section II.3.NC Growth Fund I does not commit to make sustainable investments with an environmental objective aligned with the EU Taxonomy and will therefore not have a minimum share of investments in transitional and enabling activities.

6. Monitoring of Environmental or Social Characteristics

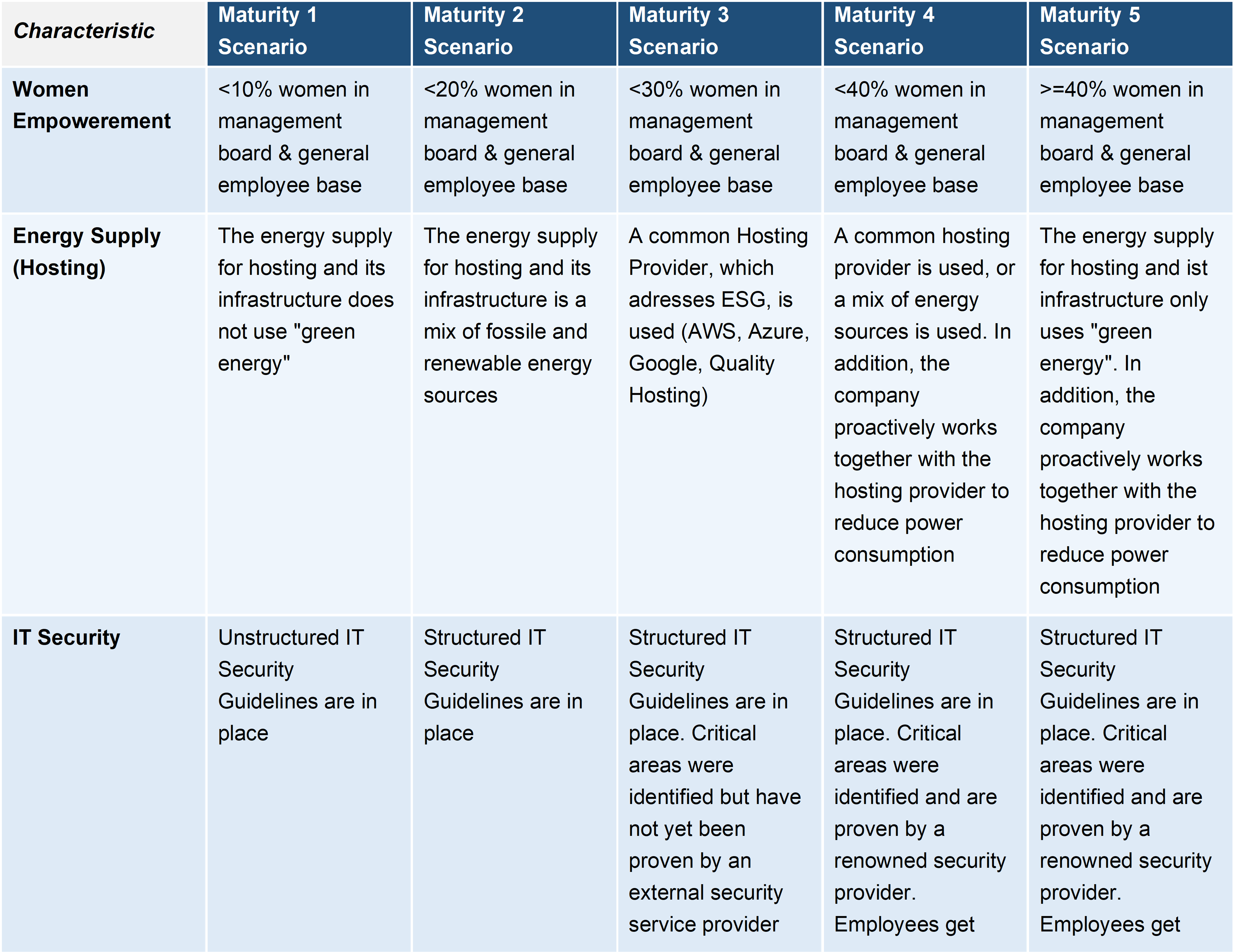

In order to attain the environmental and social characteristics promoted, NC Growth Fund I carefully monitors that its portfolio companies comply with the environmental and social characteristics promoted.To ensure an objective measurability of the promoted environmental and social characteristics, five maturity scenarios for each of the promoted characteristics have been developed. Each scenario precisely describes what a company has to do to reach the next maturity level in one specific characteristic. The following table shows an excerpt of the Maturity Scenario Matrix.

In addition, the proprietary Maturity Scenario Matrix was transferred into a co-developed software platform to ensure thorough documentation of Assessments, reasoning on assessed maturity levels as well as documentation of derived measures and overall ESG development per portfolio company. .

Yearly assessments are conducted on each portfolio company. To further ensure objectivity, the assessment is done in management sessions and further supplemented by extensive internal company documentation.